The HMA.

The solution to:

High medical expenses.

High deductibles.

Planned dental, lasik or elective surgeries.

What is a Health Matching Account?

The HMA® (Health Matching Account) is the ultimate medical benefit savings account. It will help both save money on out-of-pocket, medical expenses and also help you with high deductibles. This is because the HMA® awards its owners up to $2 in medical benefits for every $1 contributed into their HMA® account balance as the program progresses. This could also allow you to raise your health insurance deductibles and lower your monthly premiums over time because the HMA® Medical Benefits Account is designed to cover out-of-pocket and medical cost obligations.

What will it pay for?

In addition to the services below, HMA® accounts are also eligible to be used to pay for elective procedures (with MD surgeons only) such as plastic surgery, lasik and fertility procedures.

These medical expenses will be covered on a mail-in reimbursement basis when you submit an original, itemized receipt within 30 days of the procedure.

Ambulance Services

Laboratory/Medical/Dental/Ophthalmic Hospital Equipment And Supplies

Doctors not elsewhere classified

Dentists, Orthodontists

Osteopathic Physicians

Chiropractors (subject to limitations)

Optometrists, Ophthalmologists

Opticians, Optical Goods, and Eyeglasses

Chiropodists, Podiatrists

Hospitals

Medical and Dental Laboratories

Medical Services and Health Practitioners not elsewhere classified

Drug Stores, Pharmacies (no sundries/mail-in reimbursement

only on grocery store pharmacy purchases)

Hearing Aid – Sales, Service, Supply Stores

Orthopedic Goods – Prosthetic Devices

Optical Goods and Eyeglasses

Counseling Service – Debt, Marriage, Personal

How does it work?

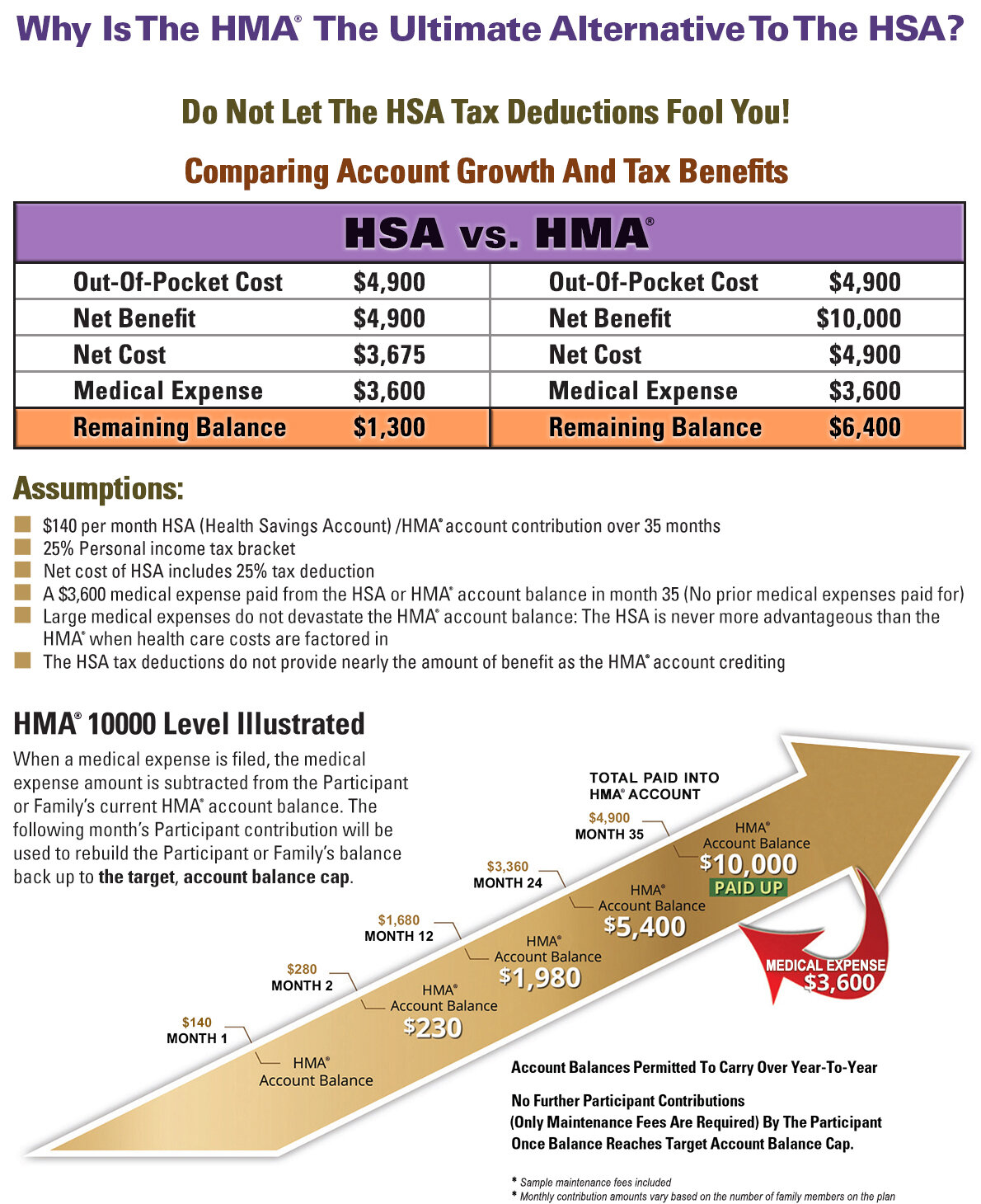

This sample illustration demonstrates how an individual or family’s HMA® account balance would grow over a three-year period.

The rapid growth of the HMA® account balance easily exceeds that of an HSA (Health Savings Account) or any other medical savings account. Over this three-year horizon, the crediting awarded to the participant’s monthly contribution is so strong that $4,900 of contribution can create a $10,000 HMA account balance in this example for the participant or family to use for their medical costs (assuming no prior medical needs). Once participants reach their target, account balance caps, which in this case is $10,000, they are no longer responsible for making a full, monthly HMA® account balance contribution (and only maintenance fees are required) until they use their HMA® Medical Benefits Account once again to pay for a medical expense.

The Health Matching Account (HMA®) is a voluntary, medical benefit savings account.

The HMA® is a non-qualified account funded by the participant with post-tax dollars.

The benefits that build in each HMA® account balance are designed to pay for an individual or family out-of-pocket medical costs including copays and deductibles in order for participants to save money and complement high deductible, major-medical plans. The participant’s HMA® account balance increases each and every month as the HMA® account crediting continues to build.

By choosing an HMA®, individuals and families now have the opportunity to fund a superior medical savings account that will permit them to increase their health insurance deductibles and lower their out-of-pocket premiums and medical expenses. In addition, HMA® accounts can also be used to pay for elective procedures (with MD surgeons only) such as plastic surgery, lasik and fertility procedures that are not traditionally covered by health insurance. The HMA® Medical Benefits Account creates additional health care savings for individuals and families by covering a larger portion of their out-of-pocket, medical expenses than any other medical savings account available.